Maryland Standard Deduction For 2025. The state of maryland offers a standard and itemized deduction for taxpayers. The minimum standard deduction has changed from $1,700 to $1,800.

The minimum standard deduction has changed from $1,700 to $1,800. The state of maryland offers a standard and itemized deduction for taxpayers.

PolicyEngine, The only change was that the standard deduction ranges. The maryland department of labor has created an unemployment insurance hotline for workers affected by the key bridge collapse.

Should You Take The Standard Deduction on Your 2025/2025 Taxes?, The minimum standard deduction has changed from $1,700 to $1,800. The only change was that the standard deduction ranges.

Fillable Online Maryland Standard Deduction Worksheet. Maryland, The only change was that the standard deduction ranges. The tax year 2025 standard deduction is a maximum value of $2,550 for single taxpayers and $5,150 for head of household, a surviving spouse, and.

Standard Deduction For 2025 22 Standard Deduction 2025 www.vrogue.co, Maryland provides a standard personal exemption tax deduction of $ 3,200.00 in 2025 per qualifying filer and $ 3,200.00 per qualifying dependent(s), this is used to reduce. Estimate your tax liability based on your income, location and other conditions.

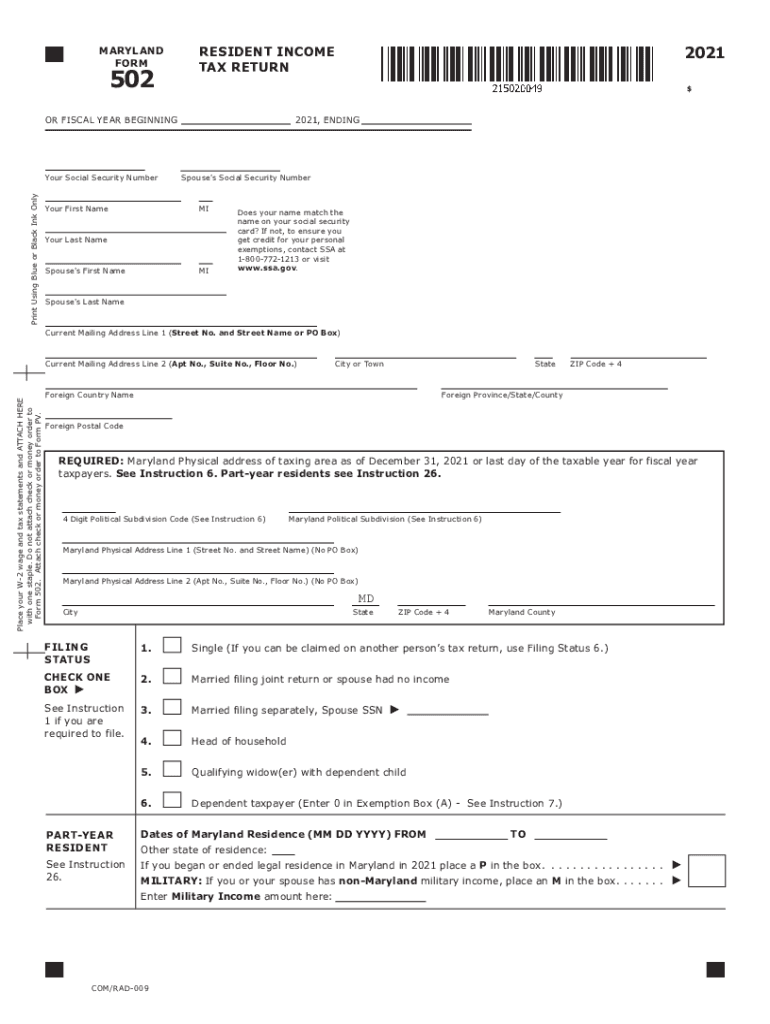

Maryland form 502 Fill out & sign online DocHub, The standard deduction amounts for the state of maryland, have changed as follows: The maryland standard deductions did increase for current tax year.

What happens if I claim 1 dependent? Leia aqui Is it better to claim 1, The tax year 2025 standard deduction is a maximum value of $2,550 for single taxpayers and $5,150 for head of household, a surviving spouse, and. Knowing the standard deduction amount for your filing status can help you determine whether you should take the standard deduction or itemize your deductions.

2025 Maryland Standard Deduction Darby Ellissa, The minimum standard deduction has changed from $1,700 to $1,800. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

New Standard Deductions for 2025 Taxes Marketplace Homes Press Release, Maryland provides a standard personal exemption tax deduction of $ 3,200.00 in 2025 per qualifying filer and $ 3,200.00 per qualifying dependent(s), this is used to reduce. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

2025 Tax Chart Irs Wilow Kaitlynn, Knowing the standard deduction amount for your filing status can help you determine whether you should take the standard deduction or itemize your deductions. Calculate your maryland state income taxes.

2025 Standard Deduction Over 65 Standard Deduction 2025, Estimate your tax liability based on your income, location and other conditions. The maryland department of labor has created an unemployment insurance hotline for workers affected by the key bridge collapse.

Calculate your income tax in maryland and salary deduction in maryland to calculate and compare salary after tax for income in maryland in the 2025 tax year.